Signs of a broader slowdown in the housing market are evident, . . . This is in line with our previous expectations and given the notable cooling of buyer demand due to higher mortgage rates. . . . Nevertheless, buyers still remain interested, which is keeping the market competitive — particularly for attractive homes that are properly priced.

Source: Selma Hepp, Interim Lead of the Office of the Chief Economist, CoreLogic

As you plan to sell your house and make your move, you may be wondering what lies ahead for mortgage rates and home prices. Here’s a look at expert insights on where both may be headed so you can make the most informed decision possible.

Mortgage rates will continue to respond to inflation

There’s no doubt mortgage rates skyrocketed in 2022 as the market responded to high inflation. The rises were swift and dramatic, with the average 30-year fixed mortgage rate exceeding 7% last fall. It was the highest they have climbed in almost 20 years.

“Just one year ago, rates were under 3%. This means that while mortgage rates are not as high as they were in the 80’s, they have more than doubled in the past year. Mortgage rates have never doubled in a year before.”

Source: Freddie Mac Quarterly Report

Because we are in uncharted territory, it is difficult to predict where mortgage rates will go from here. Forecasting mortgage rates is far from a precise science, but experts believe that mortgage rates will continue to respond to inflation in the future. If inflation falls, mortgage rates are expected to fall as well.

Home price changes will vary by market

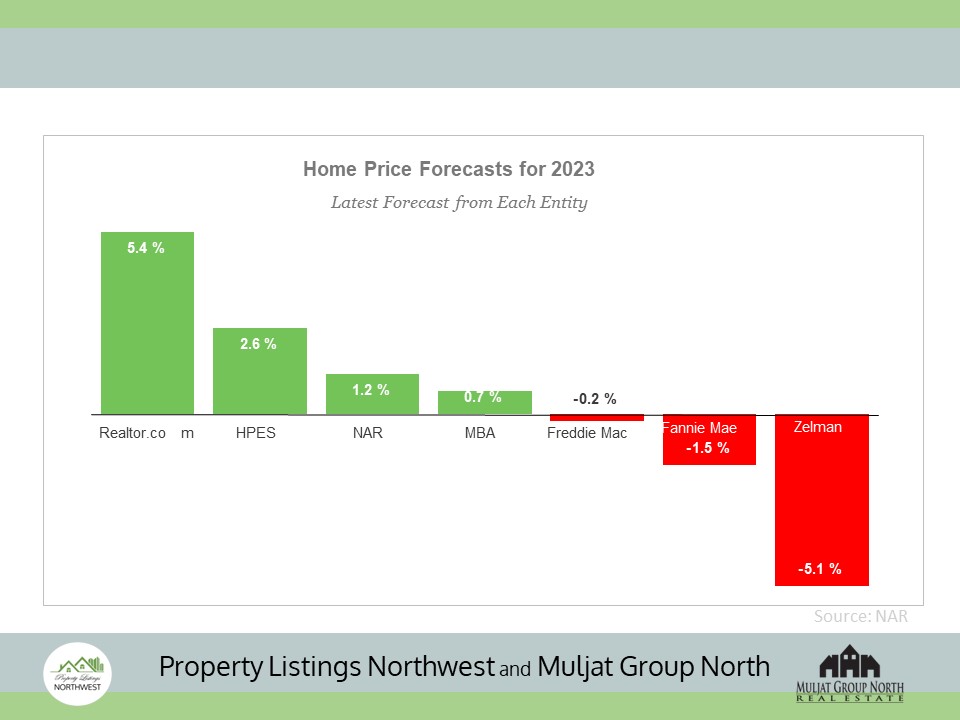

Home prices have softened in several cities as buyer demand has decreased in reaction to increasing mortgage rates. In terms of forecasts for 2023, some experts predict a small price rise, while others predict slight price decreases (see graph below). To get the complete picture, the best way to look at it is to average all of the expert projections together. When we do it on a national scale, we get roughly a neutral or flat appraisal for 2023.

In the future, house price appreciation will vary by the local market, with more significant changes occurring in hot regions. It all depends on other factors at work in that local market, such as the supply-demand balance.

“House price appreciation has slowed in all 50 markets we track, but the deceleration is generally more dramatic in areas that experienced the strongest peak appreciation rates.”

Source: Mark Fleming, Chief Economist at First American

Bottom line

If you’re thinking about selling your home, you might be hesitant because mortgage rates are still somewhat high compared to previous years. Even though it’s true that rates are higher, there are other non-financial factors to consider when it comes to making a move. Whether you want to know what’s going on with property prices or mortgage rates, let’s talk so you can stay up to date on what experts are saying and what it means for our area.