The housing market has started off much stronger this year than it did last year. Lower mortgage interest rates have been a big factor in this change. The average 30-year rate in 2019 as reported by Freddie Mac was 3.94%. We are now closer to 3.5%.

The Census Bureau also reported the highest homeownership rate for people under 35 since 2014. This is evidence that owning their own home is becoming important to Millennials as they reach the age where marriage and children are part of their lives.

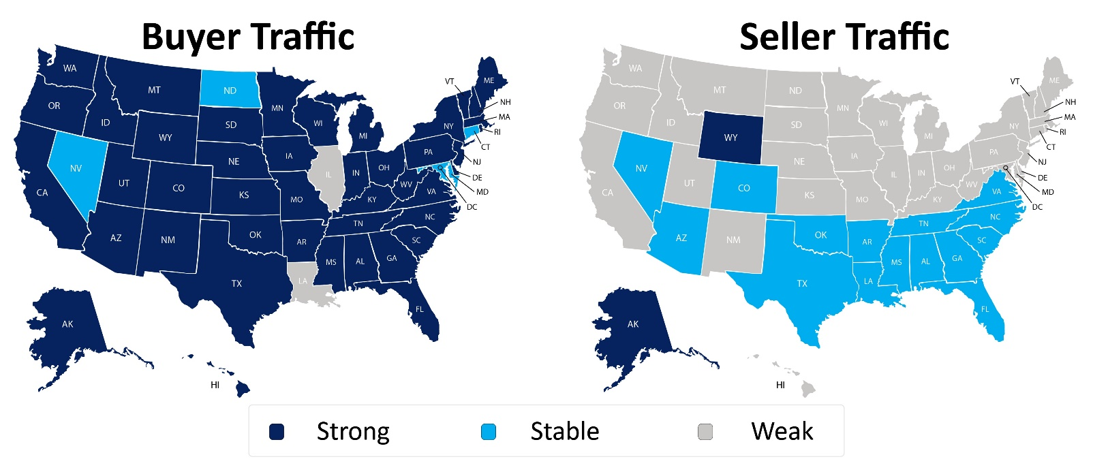

According to the latest Realtors Confidence Index Survey from the National Association of Realtors (NAR), buyer demand across the country is strong. That’s not the case, however, with seller demand, which remains weak. Here’s a breakdown by state:

Demand for housing is high, but supply is extremely low. NAR indicates the actual number of homes currently for sale stands at 1.42 million, which is one of the lowest totals in almost three decades. Additionally, the ratio of all existing homes for sale to the number purchased is 3.1 months of inventory. In a normal market, that number would be double that at 6 months of inventory.

What does this mean for potential sellers?

If you’re thinking of selling, you may not want to wait until spring to put your house on the market. With demand so high and supply so low, now is the perfect time to sell for the greatest dollar value and the least hassle.

Bottom Line

The real estate market is entering the spring like a lion. There’s no indication it will lose that roar, assuming inventory continues to come to market.